How Life Insurance Can Power Your Retirement

Personal Presentations Available

Never spend another second worrying about outliving your money,

and prepare to ENJOY your retirement to the fullest.

Please join Tom Hegna and me for this special Webinar. Tom Hegna is

an economist, author, and retirement expert. He is considered by many to

be THE Retirement Income Expert. I am co-hosting this webinar with him.

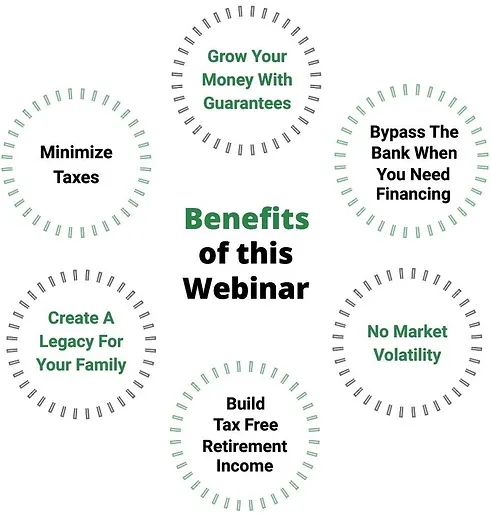

Become Your Own Banker

Personal Presentations Available

You can take control of your money using the Infinite Banking Concept (IBC), where you combine banking principals with dividend paying Whole Life Insurance. Your money is safe with infinite banking plans and averages

higher returns than a high interest savings account. It’s growth is exempt

from taxes, and your money is accessible to use at anytime to make

purchases without interrupting its growth! Having constant uninterrupted

growth on 100% of your cash, even while you use it, is one of the hallmarks

of an Infinite Banking Concept. With these plans, you are creating your

own private banking system and growing tax-free retirement income at the same time. You are building wealth, building cash-flow & building a family legacy.

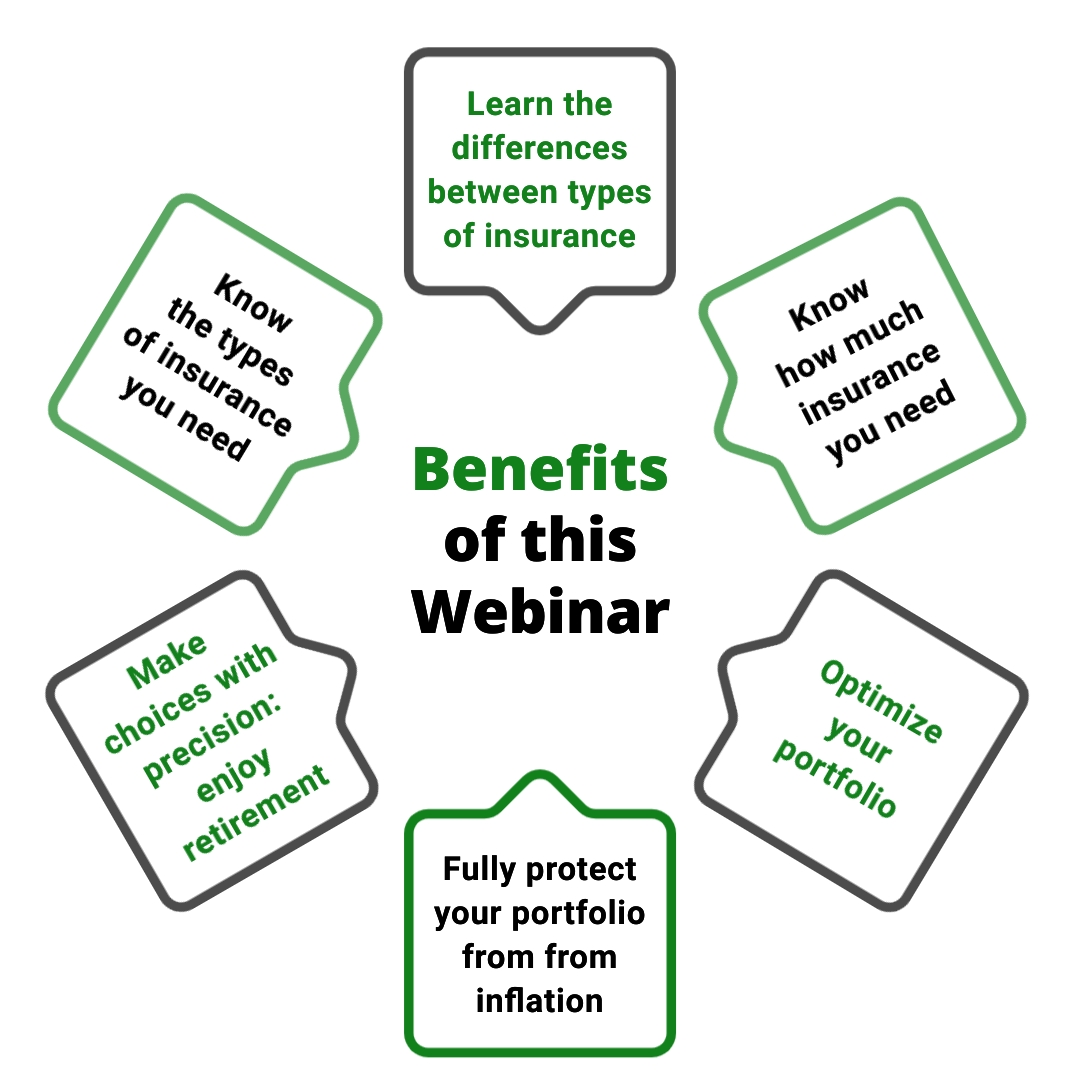

The Insurances You

Need and Why

Personal Presentations Available

While most people do not like to talk about insurances,

they are incredibly important to create a stable and

healthy financial plan. Insurances protect your most valuable

assets; your ability to work, to make an income and

to take care of the loved ones around you.

They offer the comfort of knowing that if anything should

happen; a disability, a critical illness, or a loss of life – the people

around you will be taken care of and will be financially stable.

This is one of the ways we at Fresh Ground Financial can help

you protect your income today, while preparing for tomorrow.

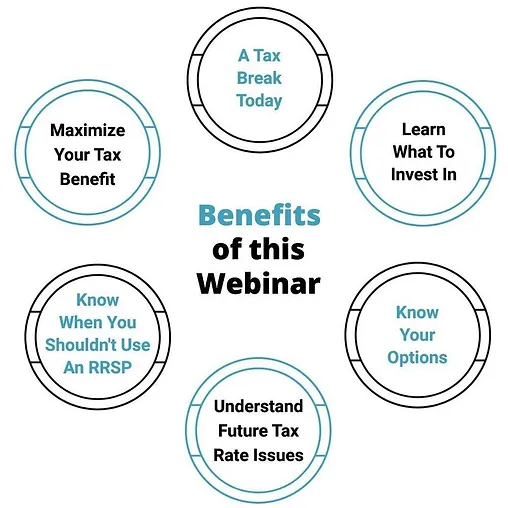

Is The RRSP Right For You?

Personal Presentations Available

It is RRSP season, so let’s take a deeper dive into the RRSP and

see how you can benefit most from using this financial tool.

LEARN THE FOLLOWING AND MORE:

. . . When does an RRSP work best for me?

. . . What are some concerns to think about?

. . . How to receive a good tax break today and then

withdraw at a rather low tax rate in a few years

. . . Options if I don’t want to contribute to an RRSP

. . . Where can I invest my RRSP in order to get a decent rate of return?

Superior Investing

Personal Presentations Available

Large institutions and pension funds do not have all their

money in the market because they have access to better options.

Let us walk you through some of those superior solutions.

If you have worked hard for your money, want to

be careful with it, have been told you need to invest in

stocks, bonds and mutual funds and you have $250,000

or more to work with, this webinar is geared for you!