Insurances Protecting Today

While most people do not like to talk about insurances, they are incredibly important to create a stable and healthy financial plan. Insurances protect your most valuable assets; your ability to work, to make an income and to take care of the loved ones around you. They offer the comfort of knowing that if anything should happen – a disability, a critical illness, or a loss of life – the people around you will be taken care of and will be financially stable. This is one of the ways we at Fresh Ground Financial can help you protect your income today, while preparing for tomorrow.

Term Life Insurance

Life insurance can be so much more than a death benefit. If structured properly, an insurance policy can be of huge benefit to you while you are living as well. Financing purchases, receiving tax efficient retirement income, and leaving a legacy for family can all be done using a well structured Life Insurance Policy.

Term Insurance can play a significant role in an overall financial plan. It protects income and brings financial safety to loved ones. This would definitely be the right choice for some people/families in their current situation. It can, however, be compared to renting an apartment. You pay regularly, your costs continually increase and at the end of the lease (insurance term) there is nothing to show for it.

Permanent Life Insurance

Protects you for your entire life (protection ends when you pass away)

Beneficiaries receive the guaranteed death benefit when insured dies

Premium payments are level (cost doesn’t change)

Cash values increase yearly (if insured cancels policy, they receive money from cash value)

Permanent insurance is sometimes compared to owning a home – you are always building equity in it.

The two main types of permanent insurance are Universal Life and Whole Life.

UNIVERSAL LIFE

Combines Term Insurance with an investment product. Tied to an interest rate or the anticipated performance of an investment vehicle.

WHOLE LIFE

Properly structured Whole Life Insurance (with dividents) is considered the most powerful and most predictable wealth building plan available because it comes with guarantees and is very tax efficient.

The premiums you pay into your Dividend-Paying Whole Life Insurance policy create a growing cash asset, referred to as the policy’s “cash value.” The money built up in the policy’s “cash value” can be used for whatever, whenever you want, making your policy act as both a savings account and a life insurance policy at the same time. Structuring your Life Insurance policy this way also gives you the opportunity to receive annual dividends.

The Advantages of a Properly Structured Whole Life Insurance Policy

Your Principal is Guaranteed

Guaranteed Yearly Growth

Tax Deferred Growth

Withdraw Tax Free, Now/ Later

Liquid and Accessible

Stable & Competitive Return

During Your Lifetime, Use The “Cash Value”

An Emergency Fund

An Education Fund

Finance Purchases (Car/Reno/etc)

Pay Off Debt

Build Your Retirement Account

Expand Your Business

The “living benefits” provide a financial resource for you to use and enjoy during your lifetime. These “living benefits” are present in addition to the legacy provided by the death benefit that will be left to your beneficiaries tax free. Properly structured life insurance is a powerful tax savings tool and a guaranteed savings plan. The death benefit is an added bonus.

Critical-Illness Insurance

Protect your income and savings from the costs that come along with having a Critical Illness, by providing a lump sum benefit, if diagnosed. The Critical Illness benefit can aid in covering medical expenses, covering living expenses while unable to work, or paying for support while in recovery. Having Critical Illness insurance relieves financial stress and burden at a time when there are many other stresses.

If your goal is to protect your income and bring security to yourself and the loved ones around you, this plan should be put in place.

The Statistics

Survival rates for these Critical Illnesses are quite high but the diagnosis and the challenges faced afterward can be a major shock.

Financial insecurity and the expenses that accumulate should not be a burden or stress on you and loved ones during these difficult recoveries.

The risks of being diagnosed with the following, in your lifetime:

Illnesses covered by Critical Illness Insurance: 4 major illnesses: Cancer, Heart Attack, Stroke, Coronary Bypass Surgery – these 4 illnesses amount to 90% of Critical Illness insurance claims.

Other Illness covered: Alzheimer’s disease, Bacterial meningitis, Heart valve replacement, Loss of limbs, Major organ failure on waiting list for transplant, Occupational HIV infection, Severe burns, Aortic surgery, Benign brain tumour, Coma, Kidney failure, Loss of speech, Motor neuron disease, Paralysis, Cancer, Aplastic anaemia, Blindness, Deafness, Loss of independent existence*, Major organ transplant, Multiple sclerosis, Parkinson’s disease.

Disability Insurance

A disability to the primary wage earner can seriously impact a households financial situation. Six months of total disability could cost up to 10 years of savings(based on 5% savings/yr), if there is no paycheck.

Protect your most valuable asset – your ability to earn an income. In the case you become unable to work due to a disability, this will provide a regular paycheck to cover regular weekly expenses and maintain a similar lifestyle as prior to the disability.

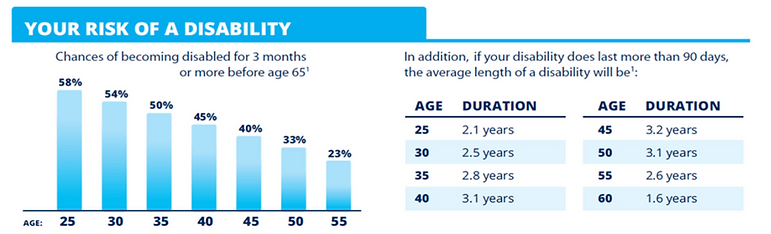

While we, of course do not expect to have a disability, research has proven that the risk of becoming disabled for 3 months or more before age 65 is quite high (charts below). Protecting your paycheque now, by having Disability Insurance, will bring security and stability to your household at a time when dealing with a disability, not financial challenges, should be ones main priority.

Mortgage Insurance

While having insurance to protect your home is a necessity, Mortgage Insurance may not be the best route to take when doing so. We would encourage you to consider purchasing your own Life Insurance policy instead, as the advantages to doing so are significant and your house will still be insured. Below you can view a side-by-side comparison of the two.

Personal Term Life Insurance Policy

- Life Insurance for a set term of your choice (5,10, 20 yrs)

- Insured owns policy

- Typically cheaper than Mortgage Insurance

- Premiums and coverage amount stay level throughout the term

- Coverage can not be cancelled by the insurer, only the insured

- You choose the beneficiary (if there is an outstanding mortgage balance, the beneficiary would pay off the mortgage and receive the rest).

- Underwriting is done prior to Insurance company offering the policy, giving a greater chance for pay out

- Insurance is yours until term is complete

Mortgage Insurance Policy

- Life Insurance for the term of the mortgage

- Bank owns policy

- Typically more expensive than Term Life Insurance

- Premiums stays level, but coverage amount may decrease as your mortgage decreases.

- Coverage can be cancelled by the bank at any time.

- Bank is the beneficiary only

- Underwriting may be done at time of death, leaving a very real possibility of not being paid out.

- Insurance from a bank is not portable. If you change banks or homes, you will need to re-qualify for insurance.

We can answer any questions you may have about insurances.

Knowing all the information will help you choose what is right for you.